BTC Price Prediction: Analyzing Technical Levels and Market Sentiment for Investment Decisions

#BTC

- Technical Consolidation: BTC trades below 20-day MA but maintains bullish MACD momentum within Bollinger Band range

- Fundamental Strengths: Renewable energy adoption and institutional interest provide strong long-term support despite regulatory uncertainties

- Risk Management: Potential $50K correction risk by 2026 requires careful position sizing and stop-loss placement

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Levels

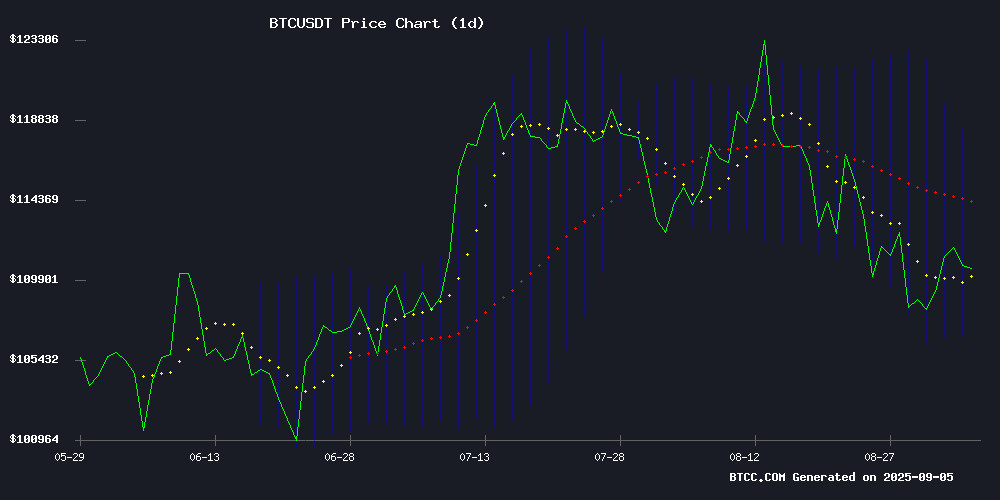

BTC is currently trading at $110,625.75, slightly below its 20-day moving average of $112,191.39, indicating potential short-term resistance. The MACD reading of 114.64 suggests bullish momentum remains intact, though the convergence between MACD and signal lines warrants monitoring. Bollinger Bands show price trading NEAR the middle band, with support at $106,814.29 and resistance at $117,568.49. According to BTCC financial analyst Ava, 'The current technical setup suggests consolidation within a defined range, with a break above $117,568 potentially triggering the next leg higher.'

Market Sentiment: Renewable Energy Adoption and Institutional Interest Offset Cycle Concerns

Recent news highlights Bitcoin's growing institutional adoption and mining efficiency improvements, with Eric TRUMP endorsing BTC as the 'gold standard' and Marathon Digital leading mining output. However, concerns about a potential $50K correction by 2026 and Fed regulatory developments create mixed sentiment. BTCC financial analyst Ava notes, 'While renewable energy adoption and institutional waves provide strong fundamental support, traders should remain cautious of cycle structure questions and regulatory headwinds that could pressure prices in the short term.'

Factors Influencing BTC's Price

Bitcoin Mining Embraces Renewable Energy for Sustainability and Efficiency

Bitcoin mining is pivoting toward renewable energy sources, marking a significant shift in the industry's environmental footprint. More than half of the network's power now derives from sustainable options like wind, solar, and hydropower. This transition not only reduces carbon emissions but also enhances operational efficiency for miners.

The decentralized nature of Bitcoin mining allows operators to tap into underutilized energy resources, particularly in regions like East Texas. By leveraging stranded renewable energy, miners stabilize local grids rather than strain them. Natalie Brunell highlights how this process secures the network while maintaining Bitcoin's fixed supply—a stark contrast to traditional fiat systems.

Renewables are becoming a strategic advantage, cutting costs and aligning with global sustainability trends. The industry's adaptability demonstrates how blockchain technology can coexist with—and even advance—clean energy initiatives.

Why Bitcoin Miners Are Sitting On A Generational AI Goldmine

Bitcoin mining infrastructure is emerging as a strategic asset in the artificial intelligence boom. Hive Digital Technologies, a $600 million market cap firm, exemplifies this shift—rebranding as a vertically integrated, renewable-powered AI infrastructure provider while maintaining bitcoin operations.

Conversion timelines tell the story: building AI data centers from scratch requires three years for permitting and construction, while retrofitting Bitcoin mining facilities takes just nine months. Wall Street recognizes the potential, with analysts projecting 300% upside for Hive's stock. Citadel Securities' recent 5.4% stake acquisition signals growing institutional interest.

Bitcoin Hashrate Hits Record High While Price Struggles Below $113K

Bitcoin's computational power reached an unprecedented milestone, surpassing 1 zetahash per second for the first time. This achievement underscores the network's growing security but contrasts sharply with its stagnant price action below $112,500.

Miners face mounting financial pressures as competition intensifies. Foundry USA Pool and AntPool now dominate the landscape, a shift accelerated by China's 2021 mining ban. Their combined might represents a new era of decentralized mining distribution.

The market shows curious divergence - Open Interest climbs while spot prices remain rangebound. This suggests either strong latent demand or sophisticated institutional positioning beneath the surface.

Bitmain Faces Legal Challenge Over Mining Hardware Dispute

Bitmain, the world's largest Bitcoin mining hardware producer, is embroiled in a legal battle with U.S. hosting provider Old Const. The lawsuit alleges Bitmain improperly terminated agreements and attempted to reclaim mining equipment without cause. This comes despite a strong year for Bitmain's U.S. operations, including a $314 million deal with Trump-backed American Bitcoin.

The conflict centers on a November 2024 agreement where Old Const purchased mining equipment and provided hosting services. Bitmain's abrupt termination notice in August 2025, allegedly based on fabricated breaches, has sparked the dispute. Old Const seeks a Temporary Restraining Order to prevent Bitmain from moving the hardware to another jurisdiction.

While Bitmain expands its U.S. footprint, this lawsuit presents an unexpected obstacle. The outcome could set precedents for hardware ownership and contract enforcement in the rapidly evolving cryptocurrency mining sector.

“Explode Higher,” Top Analyst Sees Bitcoin and Altcoin Rallies After Tepid U.S. Payrolls

Crypto markets surged Friday as a weaker-than-expected U.S. jobs report fueled expectations of Federal Reserve easing. Bitcoin reclaimed momentum, with analysts eyeing a breakout toward mid-six-figure levels. Altcoins showed signs of impending strength as Bitcoin dominance hovered NEAR 56% of the $3.9 trillion total market capitalization.

Spot gold's record surge mirrored the market's risk-off sentiment, with traders interpreting the payroll data as a catalyst for looser monetary policy. The 22,000 August jobs figure and rising unemployment rate at 4.3% cemented bets on the Fed prioritizing employment support over further tightening.

Market structure suggests potential altseason momentum, according to Swissblock's Henrik Zeberg. The setup resembles historical patterns where Bitcoin leads before capital rotates into altcoins. Traders are positioning for what could become a broad-based crypto rally should macroeconomic conditions continue favoring risk assets.

Bitcoin Cycle Structure Questioned As VDD Mirrors Historic Tops

Bitcoin's momentum falters above $112,000 as selling pressure mounts, leaving analysts divided on its next move. Some anticipate a correction, while others predict consolidation before a decisive breakout. The market's fragile balance between bullish Optimism and caution underscores the uncertainty.

Darkfost, a prominent analyst, reignites debate over Bitcoin's traditional cycle structure. Long-term holders remain a consistent force across cycles, with dormant BTC movements often triggering significant selling pressure. This cycle has already demonstrated that pattern, as Coin Days Destroyed (CDD) spiked during Bitcoin's climb to all-time highs earlier this year—a historical precursor to tops and corrections.

Value Days Destroyed (VDD), a metric tracking older coin movements with price-weighted analysis, now offers critical insights. Darkfost suggests VDD may signal potential relief for Bitcoin, though its implications remain nuanced. The metric's behavior mirrors historic patterns, leaving market participants to decipher whether this signals a local bottom or prolonged consolidation.

Weekly Crypto Regulation News: Fed Sets Stablecoin Showdown and Spot Trading Gains Momentum

The Federal Reserve has positioned stablecoins at the forefront of financial innovation with its upcoming Payments Innovation Conference on October 21. This MOVE follows the enactment of the first U.S. regulatory framework for stablecoins, signaling a pivotal moment for the intersection of traditional finance and decentralized systems. Federal Reserve Governor Christopher J. Waller emphasized the need to balance innovation with stability, underscoring the evolving demands of consumers and businesses.

Meanwhile, the crypto market witnessed significant developments, including a billion-dollar Bitcoin mining windfall for the Trump sons and U.S. regulators opening the door for spot crypto trading on registered exchanges. Hollywood's entanglement in a $340 million DeFi Ponzi scheme further highlighted the growing complexities of the digital asset landscape.

Bitcoin Dips 2% Amid Fed Easing Speculation Despite Weak U.S. Jobs Data

Bitcoin's price trajectory suggests a potential climb to $108K by the weekend following a weaker-than-expected U.S. jobs report. Non-farm payrolls missed estimates at 22,000 versus 76,500 expected, while unemployment ROSE to 4.3%, signaling economic cooling. The data bolsters the case for Federal Reserve policy easing, yet BTC's daily candle turned bearish after an initial spike to $113,384.

Historically, Bitcoin thrives in lower-rate environments as reduced pressure on risk assets fosters liquidity inflows. Traders are now pricing in a softer dollar and declining Treasury yields, which could propel BTC's momentum. However, the Fed's September decision remains uncertain—while the jobs data leans dovish, it may not be enough to justify an immediate rate cut.

A startling revelation underscores the labor market's strain: 10.5% of Americans aged 16–24 are unemployed, surpassing 10% for the first time since the pandemic. This demographic shift highlights growing challenges for young job seekers, further complicating the economic outlook.

Marathon Digital Leads Bitcoin Mining Output in August Amid Global Competition

Marathon Digital Holdings (MARA) outperformed rivals Riot Platforms and CleanSpark by mining 705 BTC in August, a marginal increase from July's 703 BTC. The firm's strategic treasury additions during the price pullback boosted its holdings to 52,447 BTC. CEO Fred Thiel attributed slower growth to a 6% surge in global hashrate competition, noting the network's average reached 949 EH/s.

Riot Platforms produced 477 BTC, while CleanSpark mined 657 BTC. BitFuFu's output fell 12% MoM to 408 BTC. Marathon's block production remained steady at 208, reflecting intensified competition. "We capitalized on the price decline to strengthen our position," Thiel stated, underscoring the firm's focus on long-term accumulation.

Eric Trump Touts Bitcoin as 'Gold Standard' Amid Institutional Adoption Wave

American Bitcoin has launched publicly with an aggressive strategy combining low-cost mining operations and large-scale BTC accumulation. Eric Trump, appearing alongside Hut 8 CEO Asher Genoot on Bloomberg, revealed the company already holds over 2,000 BTC while claiming production costs at 50% below market rates. "The floodgates are just starting to open," TRUMP declared, positioning Bitcoin as the digital gold standard amid growing institutional interest.

The partnership with Hut 8 leverages Texas wind farm energy to maintain cost advantages. Genoot confirmed the infrastructure arrangement enables flexible operations while building what Trump describes as an "unbelievable advantage" in the emerging institutional adoption cycle. Market observers note the public rollout strategically aligns with Bitcoin's broadening recognition as a treasury asset.

Bitcoin's Four-Year Cycle Suggests Potential $50K Correction by 2026

Bitcoin's recent volatility has reignited debates about its cyclical nature. After reaching an all-time high above $124,000 in mid-August, the cryptocurrency has pulled back to around $110,958, leaving market participants questioning its next move.

Joao Wedson, founder of Alphractal, warns that Bitcoin's historical four-year cycle could signal an impending bear market. His analysis suggests a potential capitulation bottom near $50,000 by late 2026, based on fractal patterns observed since Bitcoin's inception. These cycles typically see peaks approximately 18 months after halving events followed by significant retracements.

The current market environment presents new variables that could disrupt historical patterns. Unprecedented institutional demand through ETF inflows and global liquidity conditions may alter Bitcoin's traditional cycle dynamics. Yet as Wedson notes, market participants frequently underestimate the persistence of these cycles at their peril.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling investment opportunity with some caution advised. The cryptocurrency trades at $110,625 with strong institutional adoption trends and mining efficiency improvements supporting long-term value. However, potential regulatory developments and cycle correction risks require careful position sizing.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $110,625.75 | Neutral |

| 20-day MA | $112,191.39 | Slight Resistance |

| MACD | 114.64 | Bullish |

| Bollinger Support | $106,814.29 | Key Level |

| Bollinger Resistance | $117,568.49 | Breakout Target |

BTCC financial analyst Ava recommends: 'Dollar-cost averaging into positions while maintaining stop-losses near $106,800 provides balanced risk management for both short-term traders and long-term investors.'